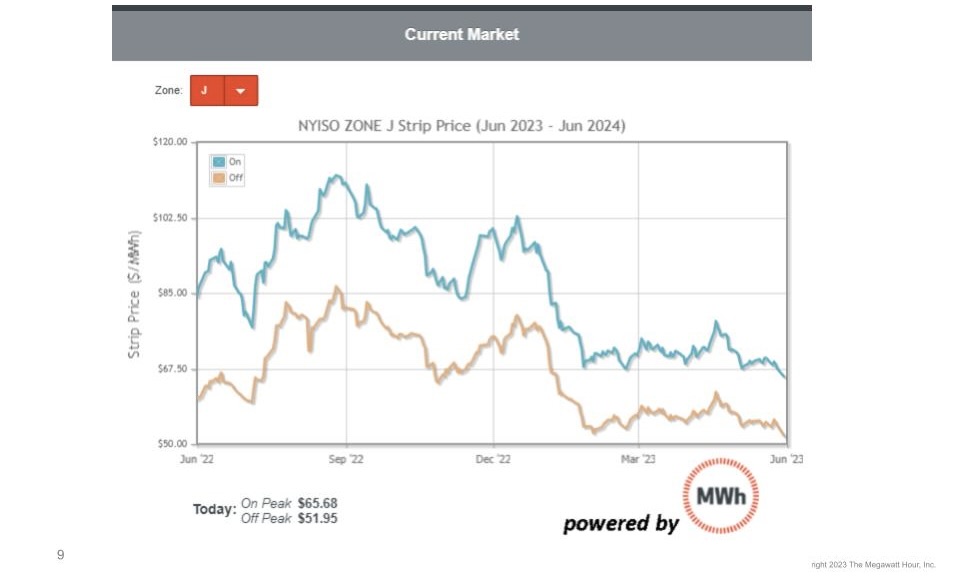

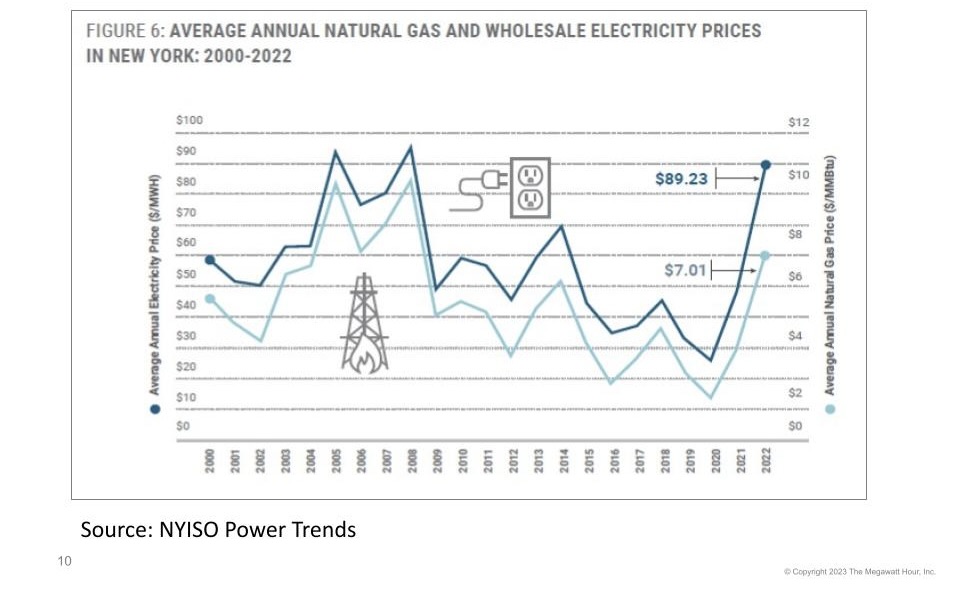

Why are we seeing volatility?

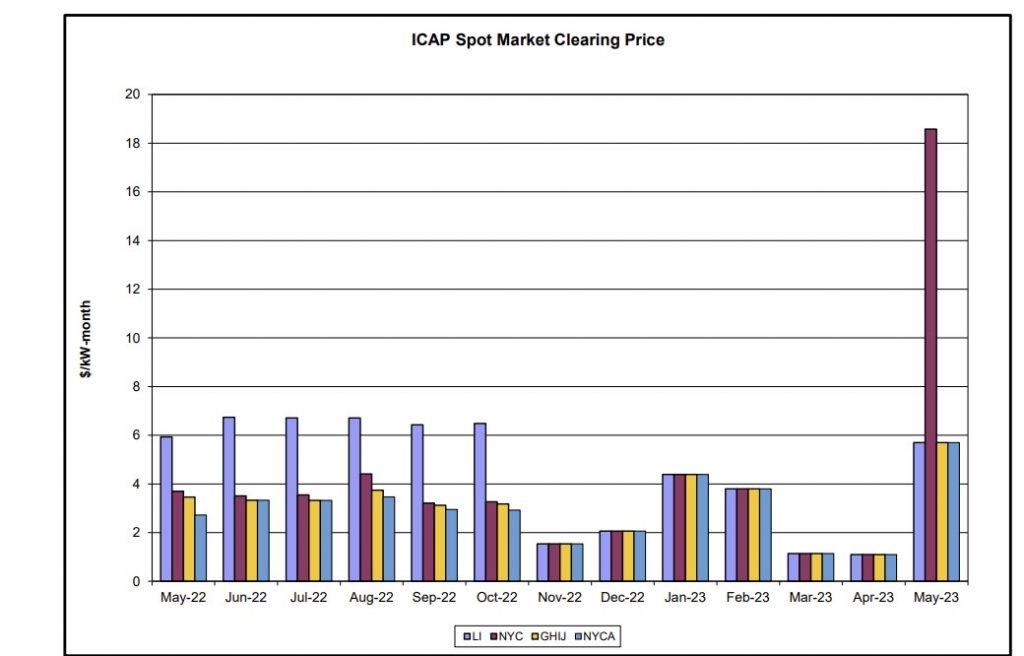

As we noted in our article “What to know about energy markets”, energy markets are the most volatile we’ve seen in over a decade. Both energy and capacity markets have grown more dynamic and volatile as you can tell from May-23 in the figure ICAP Spot Market Clearing Price. While we can point to some factors driving this volatility, it is nearly impossible to predict how the market will look in the future. What is clear, however, is that as we phase out natural gas and fossil fuels, it is even more important to pay attention to energy markets and to pay attention to the dynamics of the energy transition.

Take Advantage of Energy Market Conditions

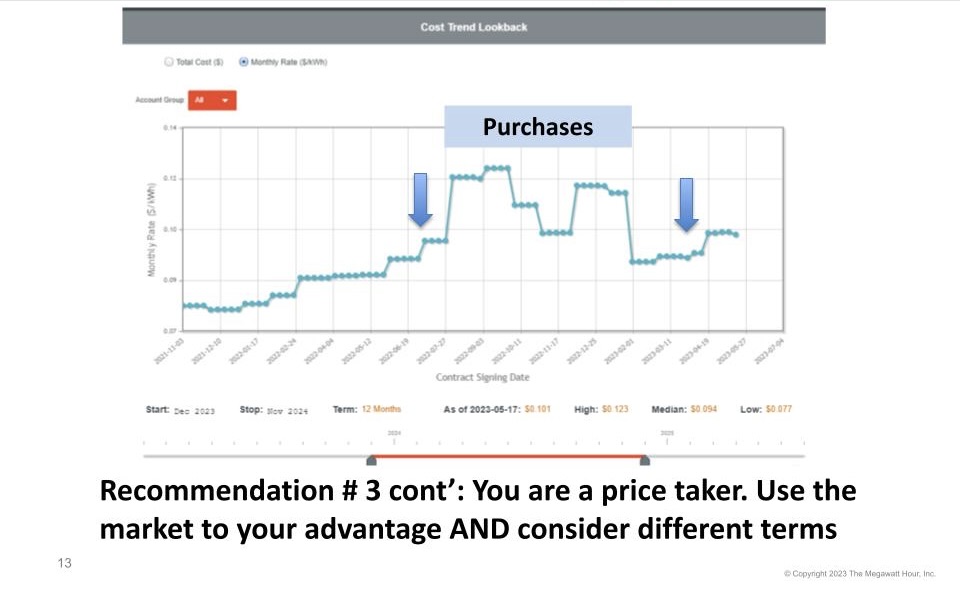

It is important to remember that energy markets are financial markets. The most significant determinant of your costs as a buyer is when you buy– it is more important than what product or what approach you take to buying. You can manage your energy costs and look at markets to inform decisions.

In addition to paying attention to markets, the following strategies can help you as you navigate these volatile market trends.

6 Keys to Navigating Volatility

- Understand market dynamics: Understanding where we are, what the history of the market is, and what the forward curve looks like is important to informing decision making. When you are operating in markets that are this volatile, it is also important to be realistic about the impact of financial markets on future costs… most customers try to plan their budgets using prior realized costs. We don’t recommend doing that. Get a forecast using current forward markets.

- Determine your risk appetite: Determine your business’ risk profile. Taking risks can be beneficial depending on your company’s risk appetite. Having the flexibility to take risks in the power and gas markets may result in lower costs over time. You have options when you engage in energy markets. You do not have to just purchase a fixed price or an index rate.

The following graph compares the monthly unit rate for 3 different energy products: a fixed price, in green, an index, in dark red or a hybrid of these two options: The index with a block of power. You need to determine what matters most to you as an organization. Then you need to be actively engaged in purchasing to make sure your purchasing strategy matches your institution’s goals: Do you prioritize budget certainty over cost? Are you willing to take some risk and let some parts of your cost float on an index? This is one of the most important conversations you can have as an organization. We would recommend that you revisit the strategy conversation regularly as markets evolve.

- Take advantage of volatility: Assuming your business is operating well and is stable, you will always be in a position to make energy purchases well into the future. You don’t need to be passive and accept pricing delivered just months or weeks before your contract expires. Purchasing energy in advance before your current contract ends will allow you to take advantage of volatility rather than being subject to it. How do you know whether to buy? Well, if you’ve determined your risk appetite and budget targets, then you will want to look for products and pricing that meet those goals.

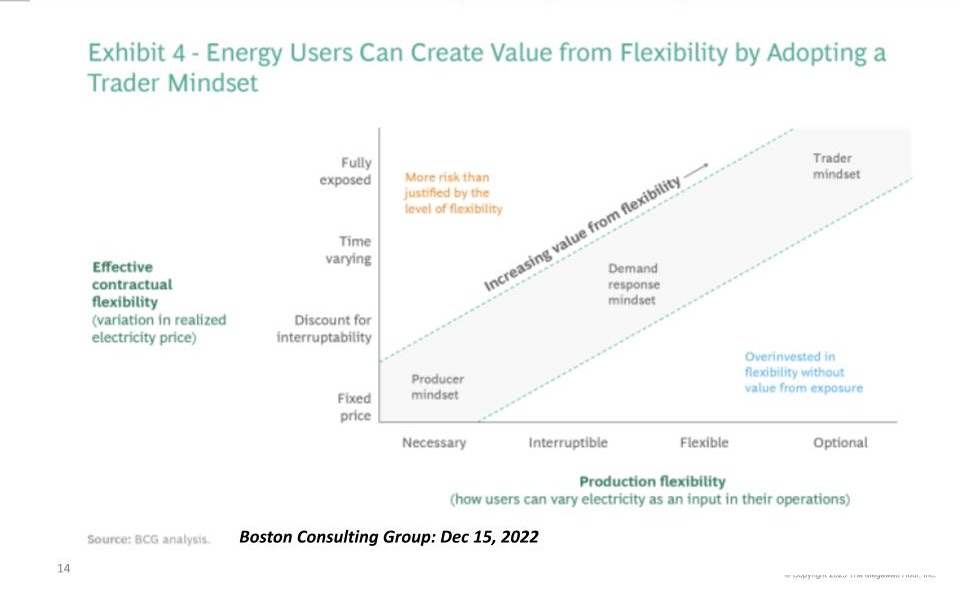

- Be flexible: The following graphic is drawn from a Boston Consulting Group article titled “What CEO’s Can Learn from Energy Traders”, largely in response to volatility in energy markets. The article recommends, to the extent possible, introducing as much market-responsive flexibility as possible into an organization. Think of your operation as being integrated with markets and make sure, to the extent possible, you are able to respond to market changes and volatility. That is typically easier to do for a manufacturing facility, for example. But there are ways to build greater flexibility into your operation no matter what your business. Adopt a trader mindset as we transition to a different grid. Customers benefit from becoming more flexible in responding to price signals and shifting operations rather than being entirely price takers.

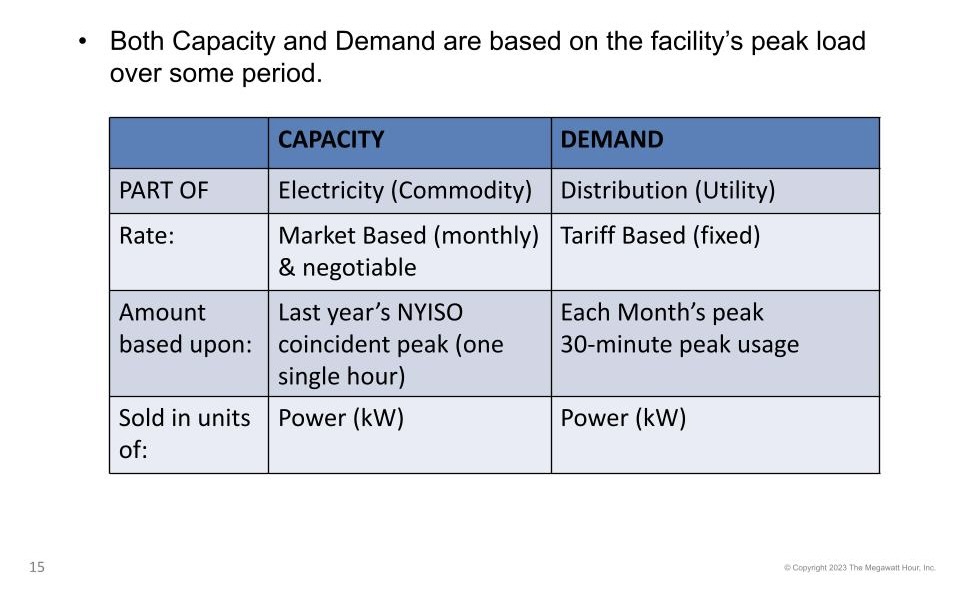

- Participate in demand response programs: Demand response programs strategically help customers reduce their costs by either reducing energy (kWh), demand (kW), which is part of the utility delivery bill, selling load reduction Capacity into wholesale Capacity markets, and/or by reducing your capacity tag.

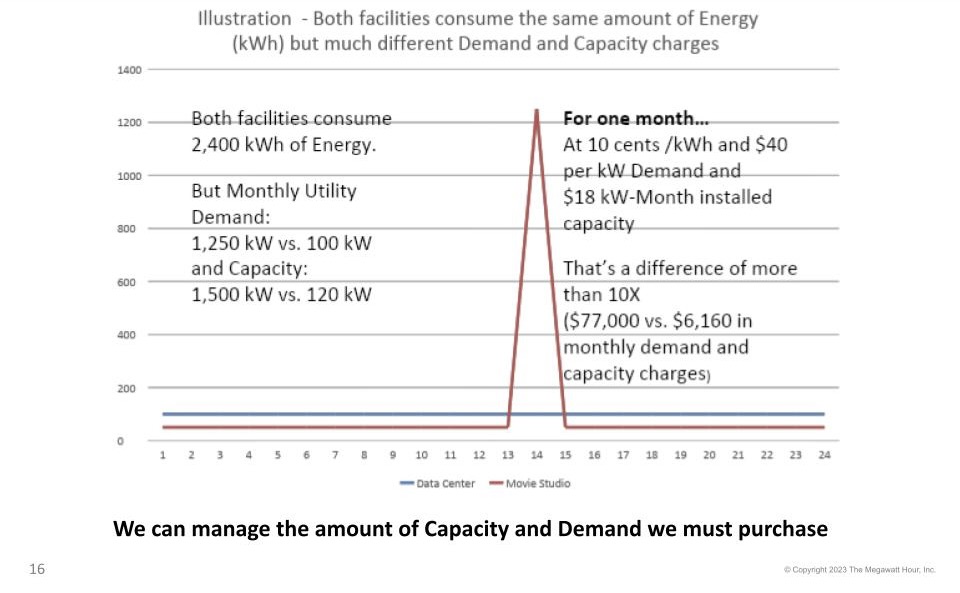

- Reducing load during peak periods can decrease demand charges and overall energy consumption. Large energy users who participate in these programs can also receive payments for reducing their electricity usage during peak hours. Managing demand and capacity during peak periods can be an important and lucrative undertaking, as you can see from the following graphic. Two customers (in this case a movie studio, in red, and a data center, in blue) can have the same kWh usage with dramatically different kW peak demand. Both facilities consume 2,400 kWh of energy on a single day. Monthly utility demand reaches 1,250 kW for the movie studio when they’re producing a film vs. 100 kW for the data center. Capacity is a similar story: 1,500 kW vs. 120 kW. For one month at 10 cents /kWh and $40 per kW Demand and $18 kW-Month Installed Capacity (ICAP), that’s a difference of more than 10X ($77,000 vs. $6,160 in monthly demand and capacity charges).

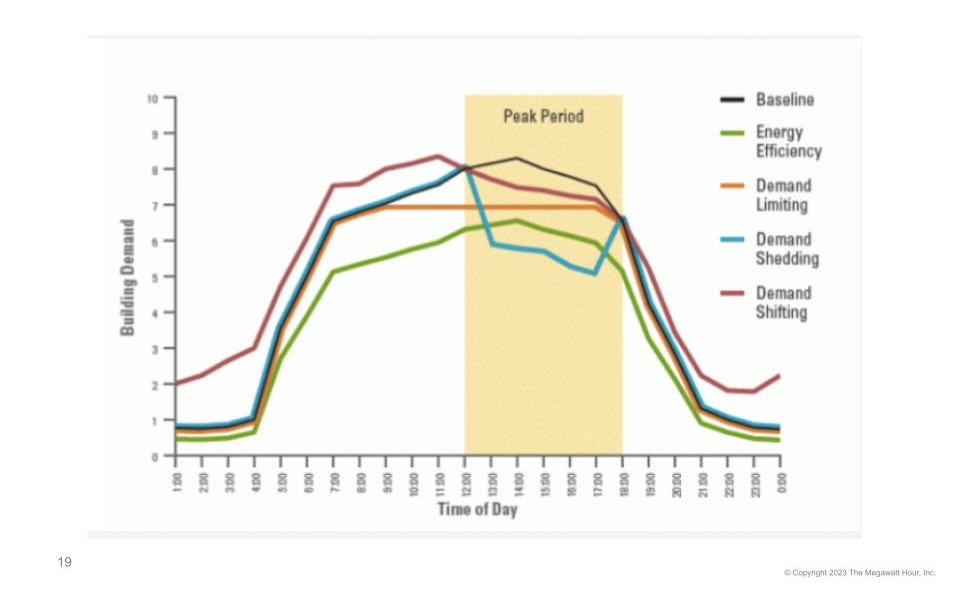

- So, how do customers effectively make the most of operational flexibility? There are a number of programs in NY state and across the country that can help customers lower their demand and capacity and achieve the benefits of these programs.

- Emergency programs are designed to maintain grid reliability during unexpected contingencies or extreme grid conditions.

- Peak Shaving Programs alert people to reduce their energy usage at peak hours to reduce cost.

- Demand Shedding is the most common strategy of reducing loads for demand response. Examples of how to shed load include turning equipment off, stopping production lines, or shifting energy usage from electricity to steam and countless other methods. The ability to shed demand at certain times can be very strategic and can result in cost reductions for a single month or, in the case of ICAP Tag reduction, the entire year.

Customers are paid to reduce their electric load during key time periods. The value of participation is extraordinary – 1 Megawatt of load reduction is worth over $250,000. in NYC in 2023. Payments are made to customers whether the program is activated or not – like a reservation payment. We may not be able to do much about the price of capacity or demand but we can affect how much we have to buy.

Contact an Aggregator like Innoventive Power, who will:

- Evaluate the facility for DR strategies and quantify the potential value

- Enroll the facility and operate the program

- Customer responsibility is to execute the load reduction plan when called

- Finally, communicate openly and often with your colleagues: Over communicate dynamics in the marketplace so you can feel confident in providing advice to colleagues. Transparency through communication is key to inform decision making especially as we confront dynamic market conditions.

Final Advice

- Notice changes in the industry. Customers cannot afford to ignore market dynamics. Pay attention to what is driving energy costs today and into the future. This will allow you to make reasonable and responsible decisions.

- Use markets to your advantage. Be flexible!

- Understand and participate in demand response programs.

- Use evidence and knowledge to make decisions, use these tools to navigate the transition.

- Set goals, identify a strategy, manage budgets, and communicate.